This past year, more than 120,100 eligible consumers bought house utilizing https://paydayloansconnecticut.com/old-hill/ the lowest-costs USDA mortgage program. USDA lenders bring particular pretty huge masters and reduced cost, smaller home loan insurance policies, and no down-payment needs.

To get entitled to an effective USDA financial, borrowers need satisfy specific money and credit standards, additionally the assets must be for the a good USDA-designated area.

Eligibility with the USDA mortgage program keeps one particular income and you can borrowing criteria, and additionally criteria into house you get.

You may be permitted fool around with an excellent USDA mortgage if the:

- The house stands within this a great USDA-appointed town

- Your meet lowest bank borrowing from the bank requirements (640 is the typical cutoff, but it may differ by bank)

- The household’s full income drops within 115% of your median money near you

- Your earnings try steady and you may uniform

- The house tend to act as most of your home

- You will be an excellent U.S. citizen, non-citizen federal, otherwise certified alien

Money Conditions getting USDA Money

To get eligible for a USDA financing, you will need a constant income source. Their lender commonly make certain it income utilizing your money data files (paystubs, W-2’s, lender comments) plus confirmation from your manager.

Money Constraints for USDA Fund

USDA fund bring a reasonable financial support selection for reasonable-to-moderate-income homeowners. Due to this fact, their household’s complete earnings can’t exceed regional USDA income limits. Money limits was calculated having fun with 115% of the area’s median house money.

The present day fundamental USDA mortgage money limit for 1-4 associate house are $103,five hundred. For five-8 member house, the newest restrict is $136,600. USDA loan constraints are highest to take into account places where construction and you can earnings try a while pricier.

Borrowing from the bank Requirements to possess USDA Fund

The USDA does not have a reliable benchmark with the lowest borrowing scores getting debtor qualification. Lowest credit conditions are prepared by lender and will will vary. The typical cutoff for the majority USDA lenders was 640. not, of several loan providers can and will help to establish your creditworthiness in different ways playing with compensating circumstances.

If your borrowing falls less than 640 or you haven’t established borrowing from the bank records, you could find you might nonetheless score a USDA mortgage by the speaking-to an educated USDA lender.

Certain loan providers usually as an alternative fool around with compensating things to show off your creditworthiness for the underwriting. Recording a healthier family savings and holding little obligations can also be significantly help. When your most recent month-to-month casing expense might be lower than your new home commission, that actually works, also.

Likewise, your bank could possibly get ask you to introduce what is actually entitled a non-antique tradeline. This is done appearing one year off towards the-time payments towards the bills, rent, health insurance advanced, and other regular costs. Exhibiting your willingness and you will power to take care of this type of monthly obligations strengthens the loan application getting underwriting.

What qualities are eligible?

Only qualities in this USDA-appointed outlying portion are present which have an effective USDA mortgage. The term rural does not only suggest farmland and you may belongings during the extremely remote portion. There are in fact many suburban qualities which might be entitled to USDA loans as well.

The condition of the home you may be buying matters, too. The brand new USDA lines particular minimal property standards (MPR’s) to ensure the domestic you purchase is a secure and you can voice financial support. In addition, these types of MPR’s improve the USDA carefully vet the house on the loan be certain that.

USDA Minimum Assets Standards

USDA lenders – and other government-backed home loan apps – need one to services satisfy particular basic conditions in advance of they’re funded.

- Immediate access to a path, roadway, or garage

- Correct utilities, h2o, and you may sewage fingertips

- A structurally sound foundation

Simply unmarried-friends residential property are available that have USDA money. Additionally, the house must serve as the majority of your household. Funding features and you can second house try ineligible.

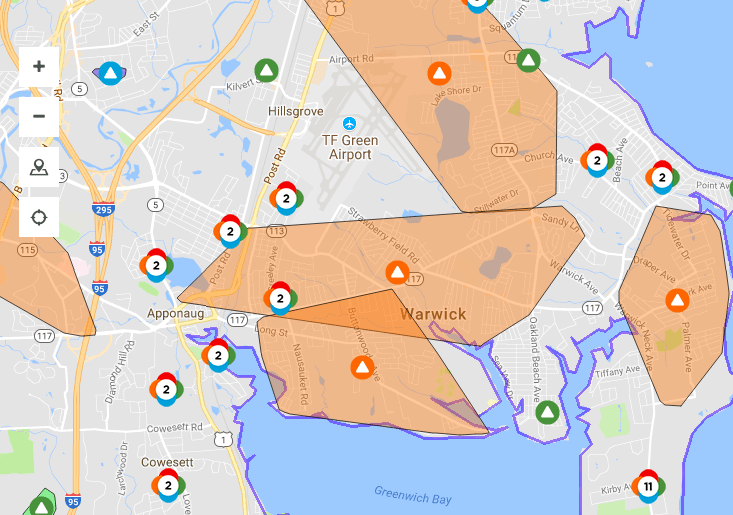

USDA Eligible Section

Home should be based in an eligible outlying area to qualify having a USDA mortgage. According to the Property Recommendations Council, 97% from U.S. residential property qualifies given that rural about USDA’s attention, bookkeeping for about 109 billion some one.