Genuinely, as the a health care professional being forced to assembled good multimillion dollars advancing years portfolio, I wouldnt think of having fun with USAA after that feel, simply because We discovered that they wouldnt accept that they understood nothing otherwise nothing throughout the handling financing of this dimensions. My car insurance rates? Certainly. Permanently.

Anything monetary outside of the practical guy which draws the typical income? (Which is we all d from it once my home loan feel.

Dividend System supplied by USAA

USAA changed. When you are there solution happens to be good, it once was world-class. I concur you have got to crack they down from the department: Banking A+ No percentage all over the world Visa? Thanks. Totally free examining/deals and you may great online financial. Insurance rates Domestic, existence, umbrella, clients previously and you may vehicles. Provider is enchanting on the numerous small-claims and something totaled vehicle more fifteen season records. Kids are riding now so we will pick. Home insurance I skip because they try not to manage my personal element of Florida, however, my personal the latest plan that have Cover Earliest is actually smaller with the a more vital home. Mortgage loans Maybe not the most affordable, however, yes the best. Have used them for starters out-of 4 fund. Investing Products are realistic which have practical costs. Trade process is easy and you will user friendly (to provide choices). Scientific studies are ok, but usually explore yahoo money otherwise yahoo funds. Had entry to a bloomberg critical to possess awhile (really unfortunate that’s gone). Now for brand new biggie——————————————— Advice Which where I have noticed the greatest alter. 15 years ago new had an assistance the place you reduced an effective apartment $1000 and you can had honest, fairly independent recommendations. My wife and i keeps resided from the you to advice for the fresh new history years and we also try financially voice with a retirement in a position collection. I stored tough, invested aggressively during the equities, securities,direct home and you will bought a term insurance policy centered on very particular requires. I mainly used USAA products and have been very lucky. Over the years we could possibly get back and you will shell out some other $one thousand all 3-five years to make certain we were focused. This last date (1yr in the past) that solution was moved and we were labeled the brand new Wide range Administration Team’. I attempted dos some other organizations (San Antonio and you can Jax) ahead of giving up. Its free’ advice was not https://paydayloansconnecticut.com/norwich/ just crappy it absolutely was horrible …….. Adjustable Consistent Life and you will an enthusiastic Annuity had been ideal priorities. I’m sure the individuals points commonly from the devil, but they are close for me. I’m forty-two and you can performs part-time, alive extremely easily towards to $100k per year which have a pension able websites portfolio. We take a trip, have no debt (except into specific earnings property) and you can spend time with our step 3 infants (529s cooking). What the hell carry out I want that have good dying benefit’ otherwise taxation deferred development on 1-4%? Did we actually can discuss the rest of all of our insurance policies? No Performed they provide certain paying belief? Zero, just by the investment classification and incredibly wide. Appear to, if you’d like actual information you now need to pay and you will pay a year centered on their holdings. I understand this is exactly common regarding the rest of the using community, but USAA encountered the the best which have an easy predetermined fee.

But not, We digress, guidance towards the investing side might $$$ passionate and never in my own best interest. I am advised that they will be happy to manage all of the my possessions for a simple annual holdings situated payment, however, that comes out over $2500+ a year, zero thank you so much. I’ve over relatively really in just some time and determination. We went my personal broker and 529 levels 8 in years past to Revolutionary on account of costs and you will greater possibilities. I became therefore displeased this last go round that we are tempted to disperse each one of my equipment (insurance coverage, banking, IRAs) from USAA. I had to help you remind myself that it’s just another high business which have weaknesses and strengths as with any the others. Its a shame whether or not, just like the I absolutely borrowing that initial suggestions years back having taking me in addition to family relations where we have been today.

Domestic Security Loan

I’ve had Allstate to have a decade and due to latest incidents are undergoing providing quotes to alter household, vehicle, and you can umbrella insurance coverage. Do USAA features aggressive bundling savings?

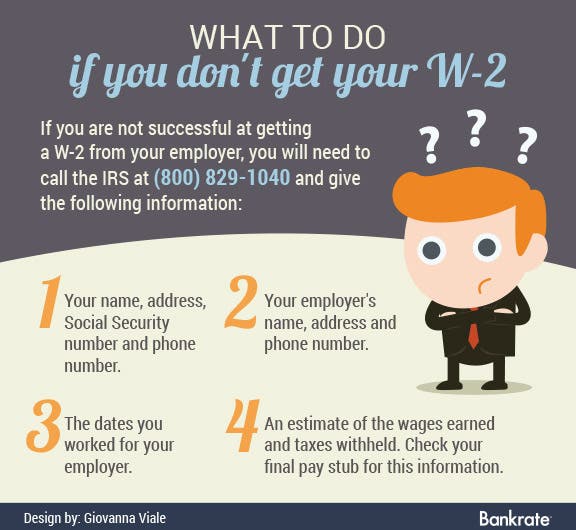

USAA, or in other words this subsidiary, are method more than the lead in dealing with so many buck home and you will modestly state-of-the-art company concepts. For instance, it remaining asking for W2’s. I had acquired business distributions away from my previous medical routine having thirteen many years, being stated from inside the K 1s.