- Create We have almost every other huge expenditures approaching? If you want to save having one thing huge, such as your child’s college tuition or a unique auto, then you might need to work on these types of needs prior to purchasing off your own home loan.

- Really does my personal lender fees a great prepayment penalty? If you are not yes if the financial boasts this percentage, call the lender and have. You’ll want to determine the newest punishment and figure out for those who however emerge ahead.

Reputable makes it possible to together with your second home loan re-finance. That have Reliable you might compare prequalified costs away from the spouse lenders within just minutes.

- Real rates out-of several loan providers When you look at the three minutes, rating actual prequalified prices instead of affecting your credit rating.

- Sline all the questions you ought to address and you will speed up the newest document upload techniques.

- End-to-stop feel Finish the entire origination processes regarding rates assessment as much as closing, all the for the Credible.

If you have decided you to definitely repaying their financial very early ‘s the proper flow, there are various an approach to do it. You don’t need to toss all of your bank account in the obligations. Rather, examine these alternatives for repaying your own financial early:

1. Refinance their financial

If you are using a home loan re-finance so you can shorten a good loan’s title, you could chop ages off the cost months when you are expenses a smaller amount of interest.

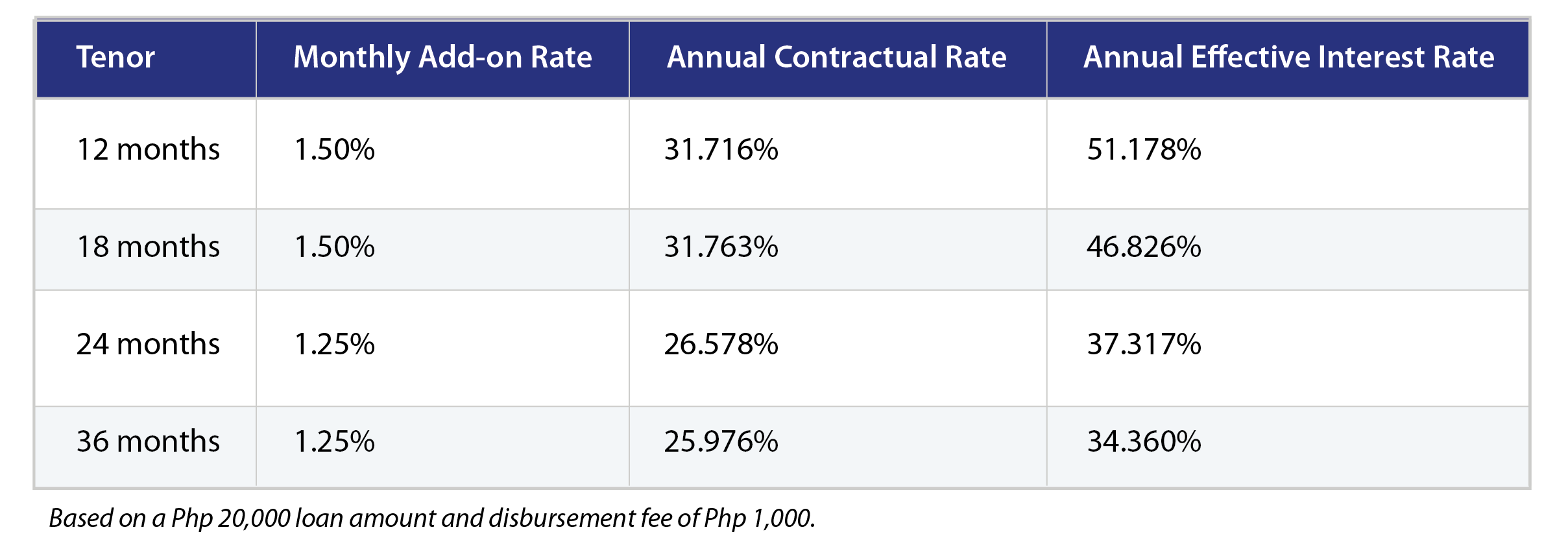

Here’s an example from how much cash you happen to be able to help save by refinancing an effective $two hundred,one hundred thousand, 30-seasons financial for the a 15-seasons fixed mortgage which have a lowered home loan interest rate:

Even after a higher payment per month, you’d conserve more $56,700 across the lifetime of the loan that have a smaller identity, whenever you only pay minimal every month.

Refinancing is not free, therefore weigh the expenses out-of refinancing and you can whether we would like to re-finance to help you a varying-price home loan or repaired-price loan.

Reliable can help you locate fairly easily brand new mortgage re-finance cost. You could potentially contrast numerous pricing from our lover lenders by using the table lower than.

dos. Create biweekly money

Which have a regular home loan, you’ll make a cost shortly after every month towards the lifetime of the borrowed funds. Certain mortgage lenders and services will let you convert to biweekly costs, which can speeds your own rewards if you take benefit of how notice is computed and paid off to your a mortgage.

When you shell out biweekly, the focus does not gather normally, to help you pay-off the mortgage faster. What’s more, it causes an extra percentage each year, and there’s twenty-six biweekly costs annually versus 12 monthly payments.

With this particular very early incentives method, the borrowed funds will be paid off three ages early which have a benefit of over $13,five-hundred.

3. Create most payments daily

If you don’t have the amount of money so you can commit to most money every month, you can always pay additional if you can manage to. Can you imagine you really can afford to invest a supplementary $eight hundred every year. Which could cause larger coupons throughout the years.

Having a supplementary $eight hundred annually, on the $eight,five-hundred from inside the attention costs fall off regarding an effective $200,100000 home loan and it will be paid out-of about couple of years prior to agenda.

4. Recast the mortgage

Recasting was an easy way to rejuvenate your own personal loans for bad credit in Philadelphia financial instead of a complete refinance. After you recast your own home loan, you will be making a massive, one-day commission into the the loan together with lender brings a unique amortization schedule for the loan’s repayments.

The fresh new payment plan will get a reduced payment per month, but one to highest lump sum your paid in and additionally reduces exactly how far desire is actually accrued monthly. That isn’t all of that preferred, but it’s recommended for most borrowers. Consult your lender to find out if it is a choice with your mortgage.